Telkom Considers Selling Shares in Data Center Business Unit – kompas.id

One of the challenges of doing business with data center facilities is that the investment cycle is long and expensive.

This article has been translated using AI. See Original .

Please note that this article was automatically translated using Microsoft Azure AI, Open AI, and Google Translation AI. We cannot ensure that the entire content is translated accurately. If you spot any errors or inconsistencies, contact us at hotline@kompas.id, and we’ll make every effort to address them. Thank you for your understanding.

AVP Shareholder Relations Telkom Indonesia Raden Achmad Faisal (second from right) attended the iftar with the media, Monday (25/3/2024), in Jakarta.

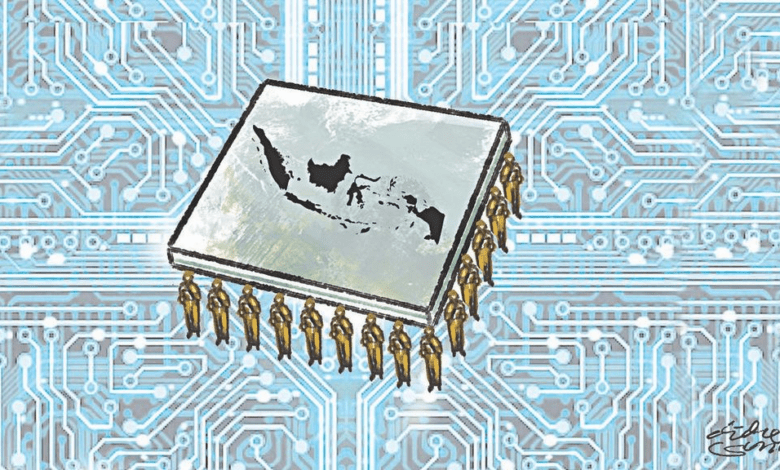

JAKARTA, KOMPAS — State-owned telecommunications company PT Telkom Indonesia (Persero) Tbk or Telkom is considering selling shares in its data center business. Currently, Telkom is targeting global technology companies that have expertise in the data center business, such as Alibaba Cloud and Equinix, to become a potential strategic partner.

“This year (implementation). We hope to remain the majority shareholder even though we release our shares,” said AVP Shareholders Relations of PT Telkom Indonesia (Persero) Tbk or Telkom, Raden Achmad Faisal, during a media gathering on Monday (25/3/2024) evening in Jakarta.

Until the end of 2023, Telkom Group owns and manages 32 data center facilities spread across four countries, namely Indonesia, Singapore, Hong Kong, and Timor Leste. The average utilization rate reaches 70 percent.

Also read: Data Center Market Movement Towards Developing Countries

The majority of Telkom Group data center facilities have technical classifications of tier 3 and 4 with a total capacity of up to 42 megawatts (MW). Throughout 2023, the company’s data center and cloud computing business posted revenue of IDR 1.9 trillion or grew 14.8 percent compared to the same period last year.

Technicians carry out routine maintenance on a base transceiver station (BTS) belonging to a telecommunications operator in the Kelapa Gading area, Jakarta, Tuesday (25/7/2023).

Raden stated that Telkom recognizes that it does not have master-level capability in the data center business. If Telkom wants to be more competitive in the data center industry, partnering with global technology companies that have expertise in data centers and early-stage computing is the right decision.

Also read: Disposal of Data Center Business Assets to Optimize Services

Telkom has also enlisted the services of Boston Consulting Group as a business advisor to support the company’s plan to sell shares of its data center business unit. Meanwhile, Telkom is still searching for a financial advisor.

“We chose to seek strategic partners instead of conducting an initial public offering (IPO) for our data center business unit because we are aware of the challenging macroeconomic conditions until 2024. There are still threats of inflation and interest rate hikes. In addition, 75 percent of companies that conduct an IPO in such a situation do not have good results,” added Raden.

Alibaba Cloud data center space

Telkom’s Vice President of Corporate Communications, Andri Herawan Sasoko, stated that in the past five years, Telkom’s revenue has only grown by less than 5 percent. This is influenced by the national telecommunications industry’s pressure due to increasingly tight competition among telecommunications companies and the proliferation of digital technology companies.

“We are striving to transform into a digital telecommunications company, one of which is through consolidating all of our data center business units. As long as we can still book revenue growth, we are working to transform our business strategy. Our data center business unit has recorded an increase in revenue, but we want to be more competitive in the coming years,” he said.

Andri added that Telkom is currently completing the construction of its latest data center facility in Cikarang, Bekasi, West Java. The capacity of this facility is up to 13 MW. If completed, the total capacity of Telkom’s data center facilities will increase from the current 42 MW to 55 MW.

Our data center business unit recorded an increase in revenue.

Based on the report “Market Insights: Powering Indonesia’s Digital Future, The Rise of Data Center Investments” issued by Colliers on March 21 2024, by the end of 2023, there will be 35 data center projects, including hyperscale and colocation types. , which operates in the Jabodetabek area, especially in the city center. The data center project, among others, serves the banking, financial services and insurance industries.

An aerial photo of traffic and shopping centers on Ahmad Yani Street in Bekasi city, West Java, taken on Friday (5/5/2023). Data centers are often developed on the outskirts of the city because the land is still relatively cheap compared to the city center.

In addition, there are five large-scale data center projects under construction in Batam, including the most prominent one, Nongsa Digital Park, with a total capacity of 221 MW. This project, designated as a special economic zone (SEZ), aims to serve as a digital bridge between Indonesia and Singapore.

Senior Associate Director of Research at Colliers Indonesia, Ferry Salanto, one of the authors in the report, stated that there is a real trend of large-scale data centers being developed in the outskirts of cities such as Bekasi, Karawang, and Bogor. This shift is driven by the need for larger-scale data center facilities with greater electrical capacity, as well as the benefits of cheaper land prices due to their distance from the city.

The same report mentions the opportunities, risks, and business challenges of data center facilities. One of the opportunities is the exponential growth of internet data consumption traffic from year to year. Some risks in running data center businesses include government regulation and carbon emissions. One of the challenges highlighted in the Colliers Indonesia report is that data center business requires a long and expensive investment cycle.

Also read: Inviting debate, public data may be stored in private data centers